reit dividend tax rate 2021

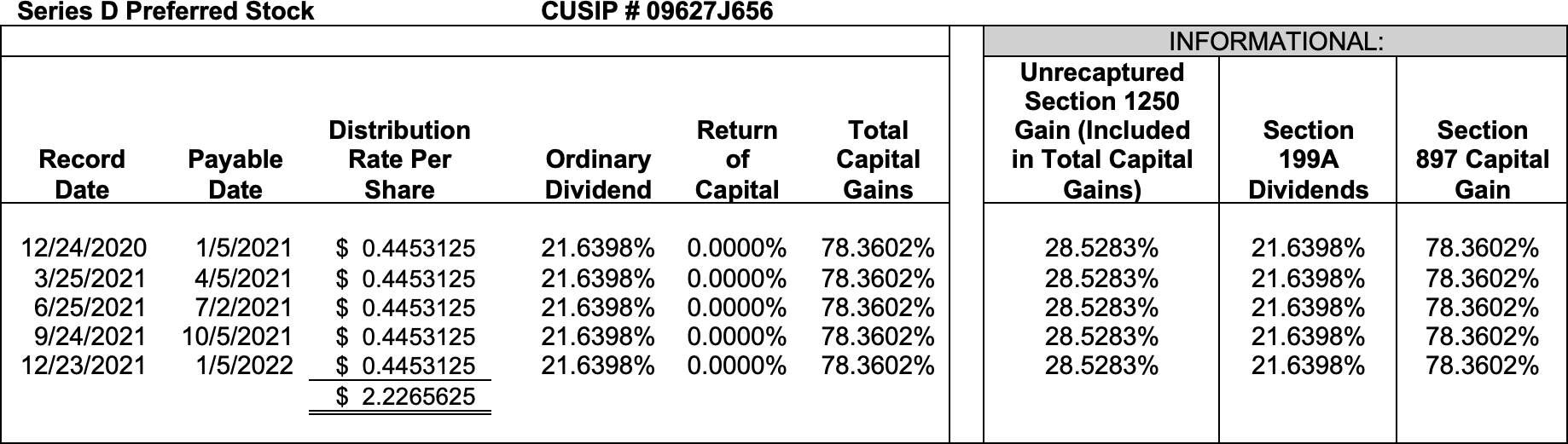

915 tax rate if shareholder owns more than 50 of the REITs voting stock. 2021 Ordinary Dividend Per Share.

Find The Best Global Talent For Your Project In 2021 Social Media Marketing Services Instagram Marketing Digital Marketing Social Media

For single filers if your 2021 taxable income was 40400 or less or 80800 or less for married couples filing jointly then you wont owe any income tax on dividends earned.

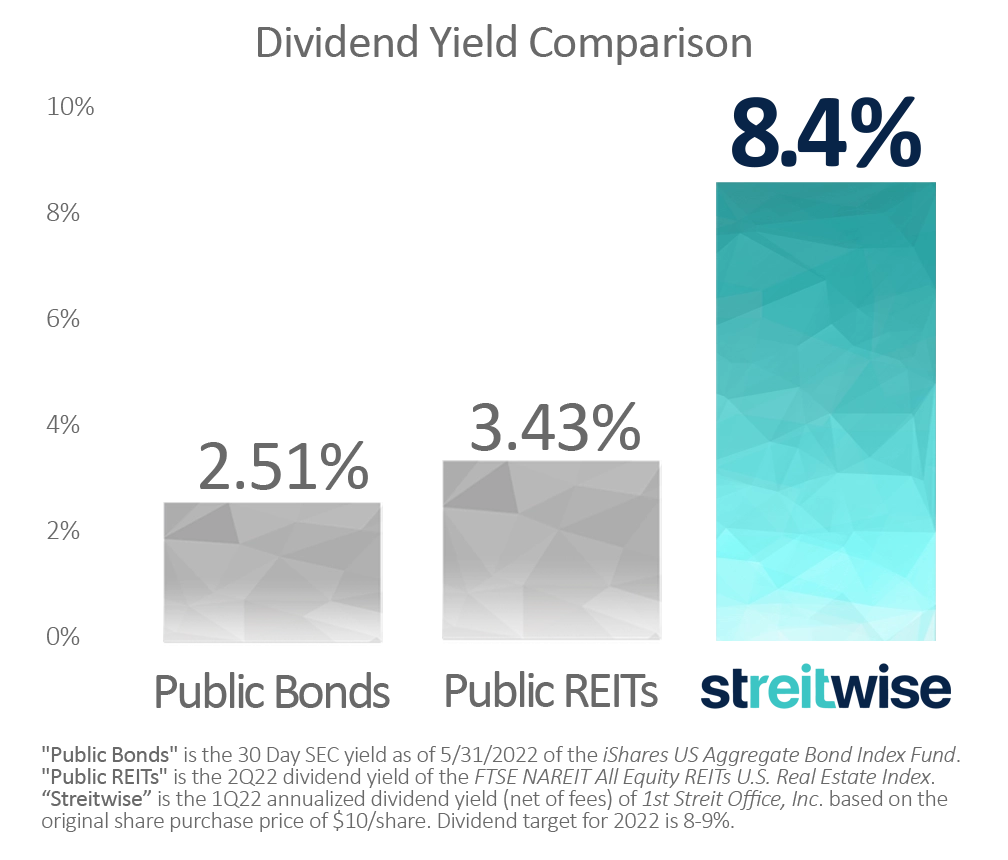

. Generally dividends from REITs are automatically exempt from being qualified dividends. Fundrise just delivered its 21st consecutive positive quarter. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income.

915 tax rate if shareholder owns more than 50 of the REITs voting stock. Qualified REIT dividends from a fund are reported in Box 5 of your Form 1099DIV. Make changes to your 2021 tax return online for up to 3 years after it has been filed.

Unrelated Business Taxable Income UBTI is a tax from unrelated business activities that would otherwise be tax free. The average risk in a severe recession is 14. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status.

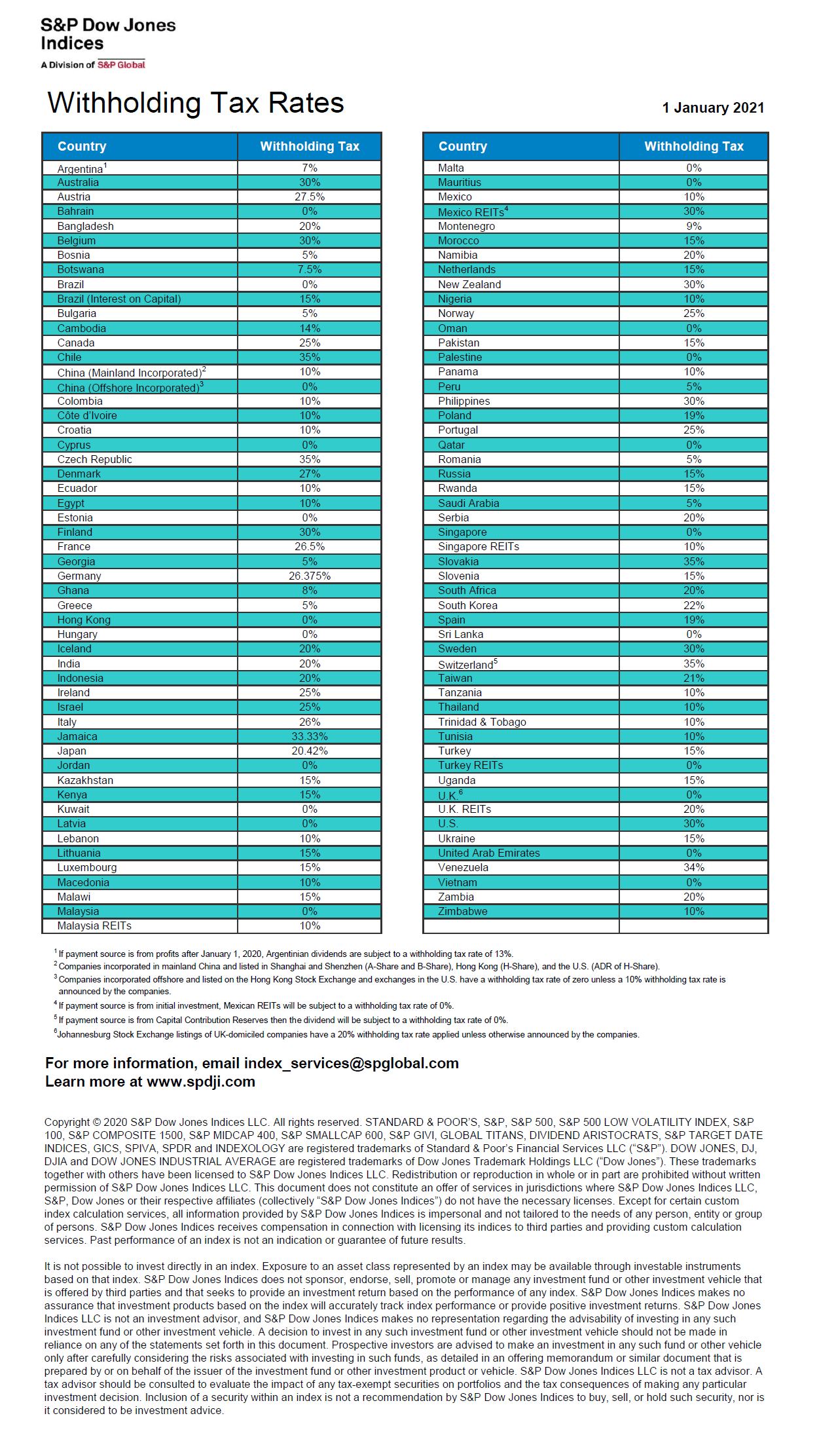

Singapore is one of the few countries in the world that charges no withholding taxes to US residents. Summary of Q1 2022 Results. Taxpayers may also generally deduct 20 of the combined qualified business income amount which includes Qualified REIT Dividends through Dec.

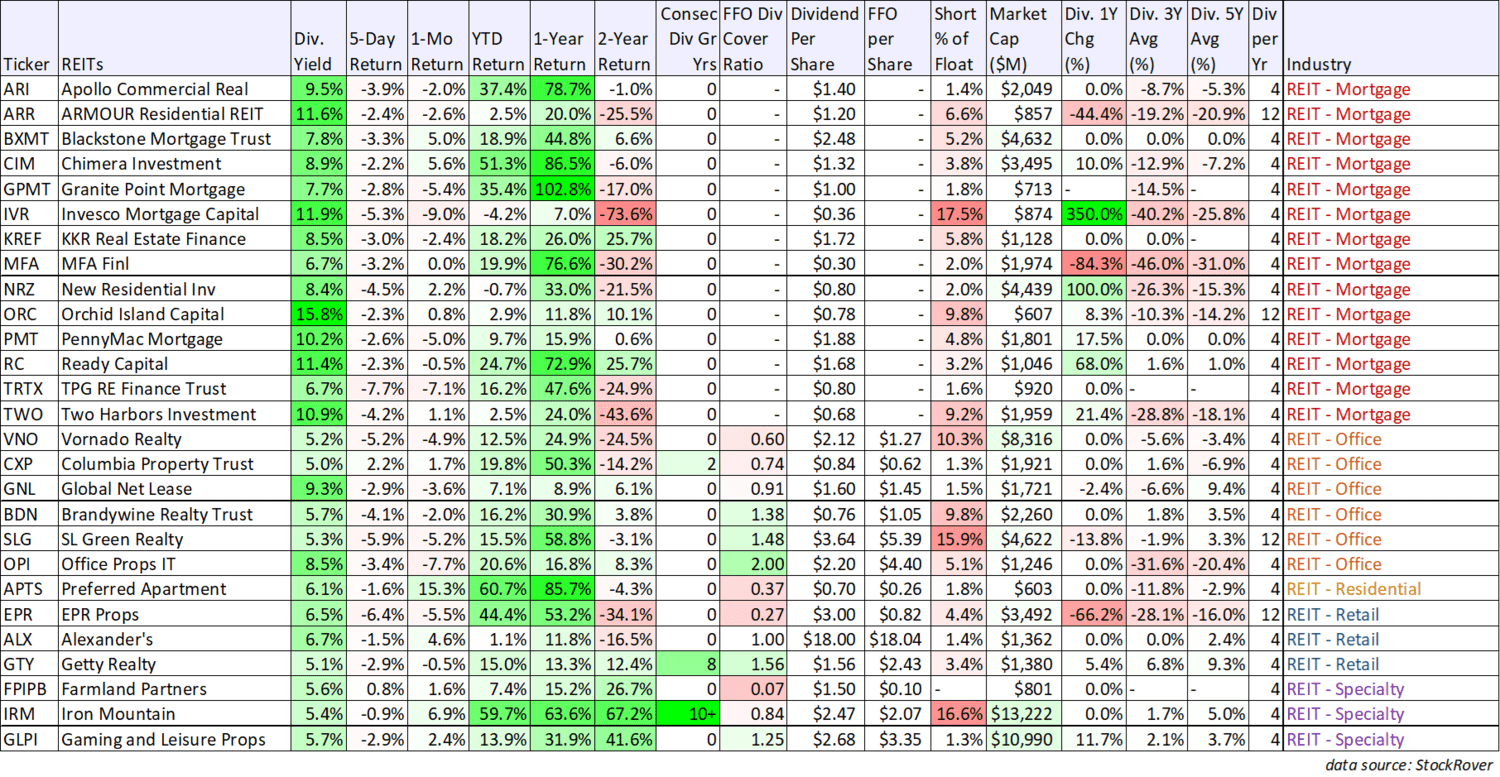

REITs and Capital Gains Taxes. Download the Complete REIT Excel Spreadsheet List at the link above. However the income thresholds for each bracket have been adjusted to account for inflation.

This REIT has supported three and five-year annual dividend growth rates of 18 and 19 respectively while. The tax rates for non-qualified dividends are the same as federal ordinary income tax rates. Geo Overview Real Estate Investment Trust Investment Portfolio Real Estate Investing A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends.

These ordinary dividends are taxed alongside your remaining income at the tax rate for which your overall income qualifies. First a capital gains qualifying event occurs if the REIT sells property that it has owned and managed. As of July 2021 the company paid a 145 annual dividend and its dividend yield was 354.

2021 Qualified REIT Dividends. The tax rate on nonqualified dividends is the same as your regular income tax bracket. While RICs can pass through qualified REIT dividends to their shareholders investors may in some situations be able to benefit from investing in the same.

Please refer to the table below. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. 4What is the 2021 Withholding Tax Rate for REITs.

Article Sources Investopedia requires writers to. Use the filter functions Greater Than or Equal To and Less Than or Equal To along with the numbers 005 ad 007 to display. Singapore Dividend Withholding Tax.

Click on the filter icon at the top of the Dividend Yield column in the Complete REIT Excel Spreadsheet List. 1What is the 2021 Singapore Withholding Tax Rate for Dividends paid to US investors. As of January 2 2013 the dividend and capital gains tax rate is 20 for investors making over 400000 and households making over 450000.

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen. Your dividends would then be taxed at 15 while the rest of your income would follow the federal income tax rates. There are two instances when your REIT will encounter capital gains taxes.

Dividends from real estate investment trusts or REITs are considered taxable income in the eyes of the IRS but theres much more to. REITs generally try to lower the amount on UBTI to. 710 if shareholder owns at least 10 of the REITs voting stock except in the case of Jamaica and no more than 25 of the REITs income consists of dividends and interest.

However a qualified REIT dividend does not include any REIT dividend received with respect to any share of REIT stock that is held for 45 days or less during the 91-day period beginning on the. Reit dividend tax rate 2021 Thursday March 17 2022 Edit. 3 Adjusting to exclude the impact of the 1690 million.

5Is there anyway to get a reduced Withholding Tax Rate. For 2021 these rates remain unchanged from 2020. The average risk of a dividend cut in a historically average recession is about 1 in 200.

A real estate investment trust or REIT is essentially a mutual fund for real estate. The REIT can then deduct all of those dividends that it paid to shareholders from its corporate taxable income. Beginning in 2018 until the end of 2025 if you are a taxpayer other than a corporation you are generally allowed a deduction of up to 20 of your qualified real estate investment trust REIT dividends.

A qualified REIT dividend is generally a dividend from a REIT received during the tax year that is not a capital gain dividend or a qualified dividend. Whilst Irish resident investors are charged tax on dividends with credit for dividend withholding tax levied at the level of the REIT non-residents are charged withholding tax on. 199A allows taxpayers to deduct 20 of their qualified REIT dividends.

This means that most REITs pay out at least 100 of their taxable inco. The tax rate on nonqualified dividends is the same as your regular income tax bracket. To qualify as a REIT the company must have at least 90 of its taxable income distributed to shareholders annually in the form of dividends.

This portion of qualified dividends gets taxed at lower capital gains rates. 2 Includes the REITs share of joint venture investments. 1 Refer to Non-IFRS Measures section below.

830 tax rate if shareholder owns 25 or more of the REITs stock.

Performance Target Returns Streitwise

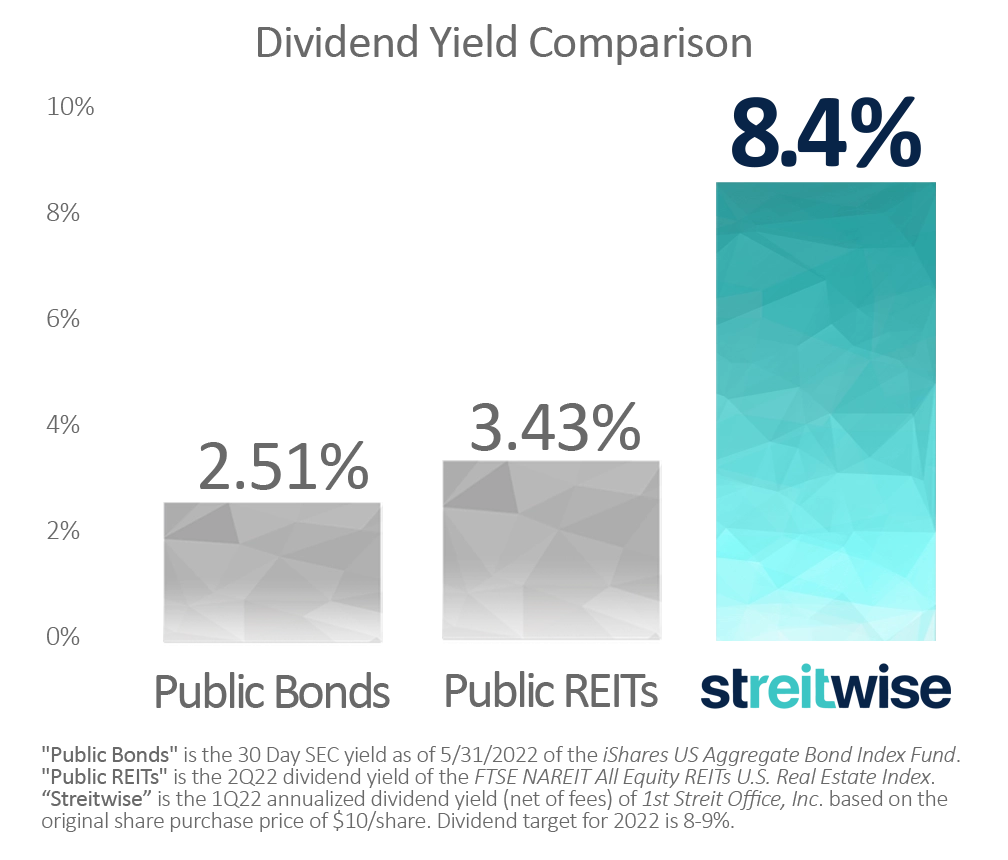

75 Big Dividend Reits Bdcs Cefs These 3 Are Worth Considering Seeking Alpha

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Reits Vs Rics The Qualified Business Income Deduction Cohen Company

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof Nasdaq

Sec 199a And Subchapter M Rics Vs Reits

5 Types Of Stocks Finance Investing Money Management Advice Investing Strategy

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Dividend Tax Rates In 2021 And 2022 The Motley Fool

Dividend Tax Rate 2022 Rates Calculation Seeking Alpha

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

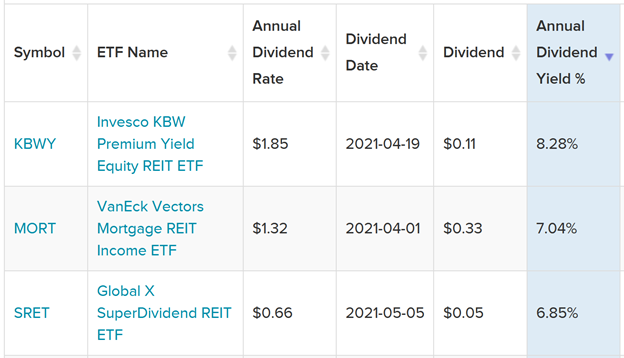

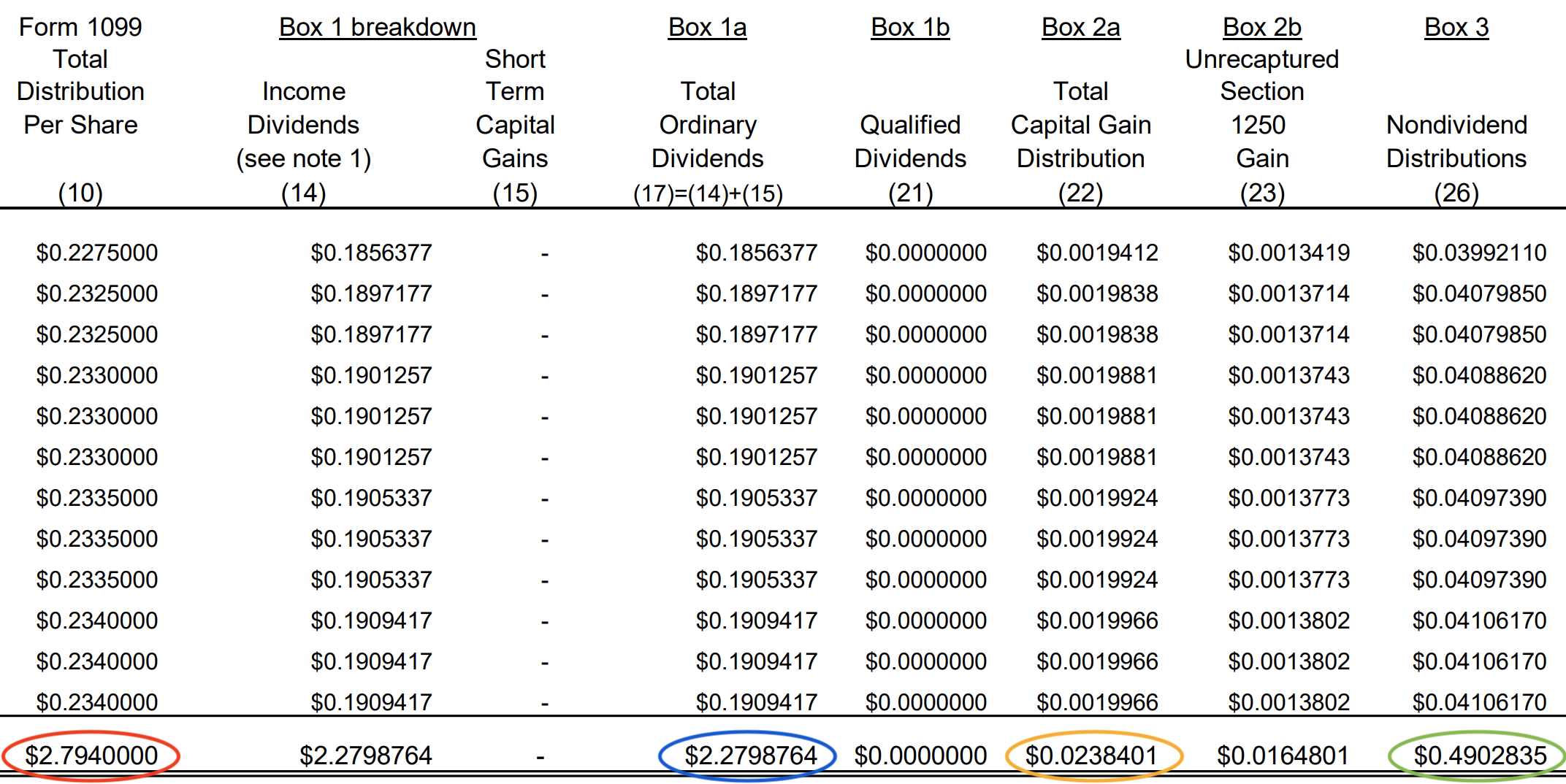

Bluerock Residential Growth Reit Brg Announces 2021 Year End Tax Reporting Information Bluerock Residential Growth Reit

75 Big Dividend Reits Bdcs Cefs These 3 Are Worth Considering Seeking Alpha

The Return Of The Dividend Recap Northern Trust

How To Get The Highest Yield Out Of Your Dividends Morningstar

Tax Implications Of A Dividend H R Block

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com